From Market Driven To Market Driving

When I was in Tamil Nadu in 2003 this article was given to me by Dr Venkatasawamy, who is mentioned in the article that he handed me. Dr V, as he was affectionately and respectfully known, must be one of the most remarkable people of recent decades.

He was born into a farming family, and in his childhood he was tasked to take the family buffalo out to pasture. He eventually trained as an ophthalmologist, and despite severe arthritis in his hands (for which he designed his own tools), he performed more than 100,000 eye surgeries. On mandatory retirement at the age of 57, he started a new lease of life. He mortgaged his house to start an eye hospital, and subsequently devised radical methods to bring cheaper and restorative eye surgery to many millions, not only in India.

He was born into a farming family, and in his childhood he was tasked to take the family buffalo out to pasture. He eventually trained as an ophthalmologist, and despite severe arthritis in his hands (for which he designed his own tools), he performed more than 100,000 eye surgeries. On mandatory retirement at the age of 57, he started a new lease of life. He mortgaged his house to start an eye hospital, and subsequently devised radical methods to bring cheaper and restorative eye surgery to many millions, not only in India.

There is plenty of material on the internet about him, and here is a brief description: https://myhero.com/Venkataswamy

The article that Dr V gave me is full of wisdom, because its concept of Market Driving versus Market Driven doesn’t apply only apply to business, but to many other significant areas of our lives. A good example is politics. For good or for bad, Mrs Thatcher was a market-driving politician; for good or for bad David Cameron was a politician who was market-driven.Two other examples (of Market Driving versus Market Driven) spring to mind. Who would have guessed that the television programme Gogglebox would be so wildly successful. No focus-group would have predicted the popularity of a programme that was only about unknown people watching their television.A further example is the lack of music in Wetherspoons, the hugely successful pub chain. If the founder, Tim Martin, had listened to market research, or the conventional hospitality-trade wisdom, his pubs would have played constant music. Instead, having read an article by George Orwell about the author’s ‘perfect pub’, Mr Martin ensured that Wetherspoon’s brimful pubs were blissfully free of background music.

![]()

FROM MARKET DRIVEN TO MARKET DRIVING

Nirmalya Kumar, IMD, Lausanne

Lisa Scheer, University of Missouri, Columbia

Philip Kotler, J.L. Kellog Graduate School of Management, Northwestern University

(From the European Management Journal, April 2000.)

Firms are constantly exhorted to become more market driven. However, our study of 25 pioneering companies (e.g. Body Shop, IKEA, Tetra Pak) whose success has been based on radical business innovation indicates that such companies are better described as market driving. While market driven processes are excellent in generating incremental innovation, they rarely produce the type of radical innovation which underlies market driving companies. Market driving companies, who are generally new entrants into an industry, gain a more sustainable competitive advantage by delivering a leap in customer value through a unique business system. Market driving strategies entail high risk, but also offer a firm the potential to revolutionize an industry and reap vast rewards. Although established companies face four major obstacles in developing and launching radical market driving business ideas, we offer several recommendations to help established companies overcome these obstacles and become more market driving.

The value of being market driven is unquestioned in companies today. Current practice dictates that success starts with careful market research, investigating the customers’ needs, and developing differentiated products or services for a well-defined segment. Various excellent companies such as Nestlé, Procter & Gamble, and Unilever effectively employ this market driven approach. However, many successful pioneering companies, who have created new markets and revolutionized existing industries through radical business innovation like Amazon.com, Body Shop, CNN, IKEA, Starbucks, and Swatch, are better described as market driving. Although market driving involves inherently high risk and many would-be market drivers fail spectacularly, when market driving strategies are successfully devised and implemented they rewrite industry rules and offer the potential to reap vast rewards. By studying the elements that contribute to the success of these market drivers, we can glean insights about the cultivation of successful market driving innovations.

Consider Aravind Eye Hospital of Southern India.1 In 1976, a 58 year old retired eye surgeon, Dr. Venkataswamy, devised a plan to serve the 15 million residents of India who were blind as a result of cataracts. Venkataswamy’s vision was to market cataract surgery, a relatively straightforward operation, like McDonald’s hamburgers. Hospitals in India typically fell into one of two categories — private hospitals that served the small, wealthy segment of the population with state-of-the-art facilities or charitable hospitals that served the poor, vast majority of the population with inadequate, out-dated, overcrowded facilities. In addition, most of the poor, who reside in the countryside, were unable to access most hospitals, which were usually located in urban areas.

To implement his vision of giving eyesight to the blind, regardless of ability to pay, Dr Venkataswamy set up hospitals in South India that serve both the rich, who pay for the state-of-the-art cataract surgery, and the poor, who receive almost identical services for free. The salesforce, advertising, and promotion of Aravind Eye Hospital focus on attracting free rather than paying patients. For example, the sales force has annual targets for the number of free patients they must generate; weekly `sales meetings’ monitor individual performance towards these targets. Aravind’s sophisticated salespeople scour the Indian countryside looking for poor patients within their assigned territories and then transport them to the hospital at no cost to the patient. Think what customer satisfaction must be like among these poor patients who regain their ability to see — for free! By focusing on eyecare and routinizing procedures, Aravind’s surgeons are so productive that this non-profit organization has a gross margin of 50 per cent despite the fact that over 65 per cent of the patients served do not pay! And unlike most nonprofit organizations in the developing world, it is not dependent on donations and attempts to maximize the number of free patients served.

What Aravind Eye Hospital shares with other market driving firms such as Amazon.com, Benetton, Body Shop, Charles Schwab, Club Med, CNN, Dell, FedEx, Hennes and Mauritz, IKEA, SAP, Sony, Southwest Airlines, Starbucks, Swatch, Tetra Pak, Virgin, and Wal-Mart is the inability of the market driven approach to explain their success. These market driving firms did not use traditional market research to devise their path-breaking strategies that challenge the status quo. Market research, while useful in generating incremental innovation, seldom leads to breakthrough innovations.2 The inspiration for the radical business ideas of these market driving firms came from a visionary such as Dr Venkataswamy, Anita Roddick of Body Shop, or Richard Branson of Virgin who saw the world differently and whose vision addressed some deep-seated, latent, or emerging need of the customer. Rather than focusing on obtaining market share in existing markets, these market drivers created new markets (e.g. CNN, Federal Express, SAP, Tetra Pak) or redefined the category in such a fundamental way that competitors were rendered obsolete (e.g. none of the top 10 discounters of 1962, the year Wal-Mart was born, are in business today).3 Ultimately, these firm revolutionized their industries by changing the rules of the game and `driving’ their markets.

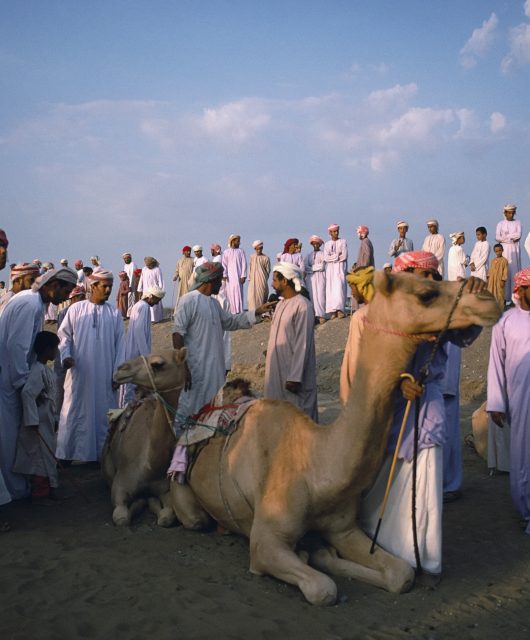

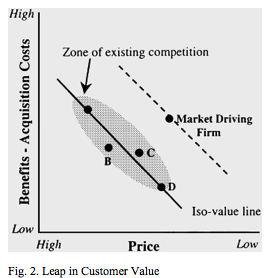

Our research indicates that the success of market driving firms is based in radical innovation on two dimensions — a discontinuous leap in the value proposition and the implementation of a unique business system (see Fig. 1).4 Value proposition refers to the combination of benefits, acquisition efforts/costs, and price offered to customers. For example, IKEA offers the benefits of clean Scandinavian design and image, tremendous assortment, immediate delivery, a pleasant shopping atmosphere, and low prices, while asking the consumer in return to engage in self-service, self-assembly, and self-transportation, often from peripheral locations. This was a dramatically different value proposition from the traditional, full service, expensive, high street furniture store. As Fig. 2 indicates, rather than playing on the existing industry iso-value line, market driving firms such as IKEA deliver a discontinuous leap in customer value.

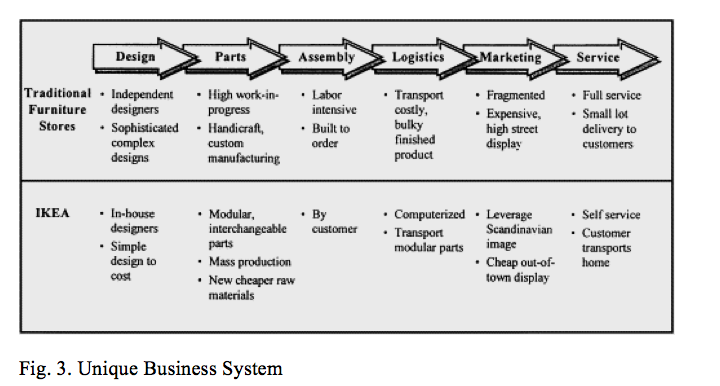

The leap in customer value provided by market driving firms may involve either breakthrough technology or breakthrough marketing. The success of Body Shop, FedEx, Starbucks, and even CNN and Wal-Mart is less about new technology than about aggressively exploiting existing technology to see the marketplace differently and to serve the customer in an unconventional manner. The key to the success of these market driving firms is that they create and deliver a leap in benefits, while reducing the sacrifices and compromises that customers make to receive those benefits (e.g. having to organize your schedule around when the networks wish to broadcast the news) (Stalk et al., 1996). They create a product/service experience that overwhelms customer expectations and existing alternatives. As a result, the landscape of the industry is substantially altered. Business system refers to the configuration of the various activities required to create, produce, and deliver the value proposition to the customer. IKEA could not deliver its discontinuous value proposition by just improving on the existing business system of the traditional furniture store (see Fig. 3).5

Traditional furniture channels were beset by expensive independent designers, high work-in-progress inventory, labor intensive handicraft manufacturing, considerable transportation and inventory of finished goods, fragmented marketing, costly high street retail locations, elaborate displays, and expensive delivery to the consumer. To deliver the discontinuous leap in customer value, IKEA had to radically reconfigure the industry business system. IKEA’s unique business system uses cost-conscious in-house design, interchangeable parts, high volume component manufacturing, parts inventory (rather than more expensive finished product inventory), extensive computerization of logistics, its natural Scandinavian image, relatively inexpensive peripheral locations, and simple display facilities, leaving final transportation and assembly to the consumer. To profitably copy IKEA’s value proposition, firms in the traditional furniture channel would need to dismantle the existing business system while migrating to a new IKEA type business system — a Herculean task indeed!

Because the value proposition is visible in the marketplace while the business system is harder to discern, competitors often miss the importance of the latter. For example, Dell delivers built-to-order customized PCs which incorporate the latest technological advances faster than its competitors and at reasonable prices. To deliver this value proposition, Dell invented a radically different business system combining minimal R&D expenditures, made-to-order flexible manufacturing systems (which give them a slight manufacturing cost disadvantage), one week of inventory consisting mostly of parts, minimal end-user advertising, and efficient direct distribution channels. In contrast, Dell’s primary competitors, Compaq and IBM, have high R&D expenditures, large run low variety (but low cost) manufacturing systems, one month of mostly finished goods inventory, extensive end-user advertising, and expensive third-party distribution channels. When Compaq and IBM tried to copy Dell’s value proposition by setting up their own direct channels, their existing business systems proved too `sticky’ to do so profitably. It is difficult to deliver customized products at competitive prices with high volume, low variety manufacturing systems and unhappy, bypassed channel members. In the absence of a unique business system, any advantage gained from a discontinuous leap in the value proposition can be copied fairly quickly by existing players. Therefore, market driving firms who change the rules of the game are those that innovate on both dimensions of Fig. 1. The unique business system creates a more sustainable advantage, as it takes time for a would-be competitor to assemble the intraorganizational and interorganizational players needed to replicate that unique system architecture.

We describe these firms as market driving for three reasons. First, market driving companies trigger industry breakpoints or what Andy Grove of Intel calls `strategic inflexion points’ which change the fundamentals of the industry through radical business innovation. Second, instead of being inspired by traditional market research as conventional wisdom recommends, the inspiration for their radical business concept usually comes from a visionary. Third, rather than learn from existing customers, they often have to teach potential customers to consume their discontinuous value proposition.

The plan of the paper is as follows. First, we contrast market driving with three other possible orientations that a firm can have towards the marketplace. We describe how market driving firms compete and seize advantage. Then, we discuss why most market driving companies are new entrants to an industry and explore the barriers and risks that large, established firms face in successfully developing and launching radical market driving innovations. Finally, we conclude with some recommendations for how established companies can become more market driving.

- How market driving firms seize advantage

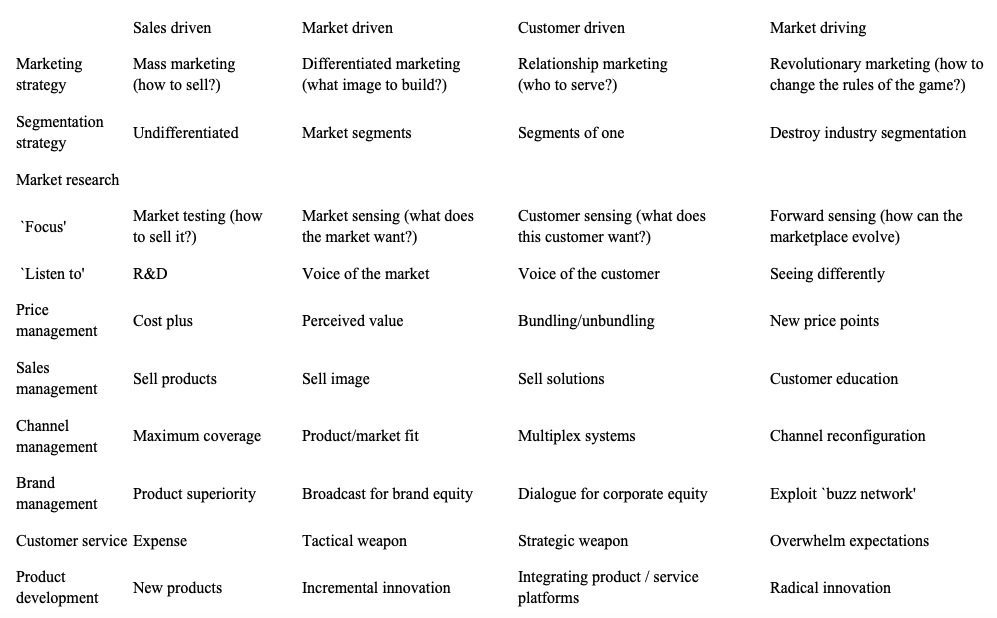

Market driving can be distinguished from three other orientations that a company can have towards the marketplace: sales driven, market driven, and customer driven. These four categories represent ideal types; no large organization adopts a single orientation throughout all of its business units. A sales driven orientation characterizes those firms who view marketing as a tool to sell whatever their factory produces. Marketing and selling are interchangeable in such companies.6 Public utilities, monopolies and some large manufacturing firms often display a sales orientation. Market driven companies instead place the customers at the start of the process and through careful market research build appropriate products for, and develop the desired image for, their target segments. Most successful consumer packaged goods companies such as L’Oreal fall in this category. Customer driven companies, on the other hand, target `segments of one’ and deliver customized value configurations to each customer. This is sometimes referred to as relationship marketing. The Swiss private banking industry, which serves high net worth individuals, is populated with several such customer driven firms. Table 1 outlines and summarizes the key distinctions between these four marketplace orientations on various elements of marketing strategy.

Table 1. Four Orientations to Marketplace

Given the focus of this paper, we concentrate on how the market driving firm competes. Our in-depth study of 25 market driving firms indicates that they share certain common features as described below.

1.1. Guided by vision rather than traditional market research

Consumers and organization buyers are excellent at motivating and evaluating incremental innovation. However, customers are usually unable to conceptualize or readily visualize the benefits of revolutionary products, concepts, and technologies. Consider the experience of Swatch. The Swatch models that received the highest intention to purchase in consumer research were those that looked the most like traditional watches. Those watches, however, ultimately generated very few sales. Instead, the more radically different Swatch models, which were rated in traditional prelaunch consumer research as the least likely to be bought, were subsequently the best selling ones. Had Swatch been guided by that market research, it would not have been a runaway success. Similarly, customers weren’t clamoring for Starbucks coffee, CNN, or overnight small package delivery prior to their introduction.

Market driving firms instead coalesce around visionaries who saw opportunity where others did not — an opportunity to fill latent, unmet needs or to offer an unprecedented level of customer value. In our research we discovered that generation and development of `the idea’ was a combination of serendipity, inexperience, and persistence. For example, Starbucks was founded in 1983 after Howard Schultz, charmed by the Italian coffee culture of Verona and Milan, promised to bring it to America. Frequently, visionaries’ relative inexperience with the industry meant they had not yet been inoculated with that industry’s received wisdom. Nike’s Bowerman was a college track coach, Club Med’s Gerard Blitz was a diamond cutter, and Ingvar Kamprad, the founder of IKEA, began his entrepreneurial career selling fish. Often, these visionaries persisted in the face of many failures and rejections to realize the dream such as Fred Smith of FedEx who developed the guaranteed overnight delivery idea in a business school term paper as a junior at Yale. He received a `C’ for the paper because the instructor was not convinced about its practicality!7 Some spent years muddling through refining their vision until everything clicked and they perfected their strategies. Wal-Mart’s initial attempts were underwhelming. David Glass, today the CEO of Wal-Mart was at that time employed with a competing store; he reportedly opined after checking out the first Discount City, `Those guys will never make it.’ Sam Walton continued to tinker with the formula until he got it right. Few of these visionaries expected that their business idea would achieve the level of success that was ultimately attained. As Hasso Plattner, the co-founder of SAP, observed: `When people ask how we planned all this, we answer “we didn’t. It just happened”'(Plattner, 1996). Even when industries are revolutionized, the market driver may not be profitable or successful in the long term. For example, Amazon.com has dramatically altered the landscape in the marketing of books, forcing industry leaders like Barnes and Noble to venture into e-tailing, even though Amazon has yet to come near an operating profit.

Because they are trying to change the rules of the game and face many obstacles on the way to success, market driving companies recruit and select people who subscribe to the values of the organization. There is often an attempt to attract those with little experience in the industry, individuals who have not been infused with the industry’s conventional wisdom about why the market driving idea is doomed to fail. Such employees are motivated strongly by their belief that they are on a mission, not simply by money, allowing them to tap into deeper motivational energies. A compelling vision enthusiastically articulated by a charismatic leader turns these employees into crusaders:

- Sam Walton believed that Wal-Mart stores would `lower the cost of living for everyone, not just America… we’ll give the world an opportunity to see what it’s like to save and have a better lifestyle, a better life for all’ energized his employees.

- Ninety per cent of Body Shop franchisees are women who have no formal business training but are instead chosen on the basis of personality tests, home visits, and attitudes towards the environment and people. They are motivated by founder Anita Roddick’s idea that they can make a difference in people’s lives and in the world through Body Shop.

- In the early days at FedEx, there were couriers who pawned their watches to pay for gasoline.

Such historic, sometimes mythic, stories become part of the organizational culture of most market driving firms.

1.2. Re-draw industry segmentation

By attracting their customers from a variety of previously-defined market segments, a new market coalesces around the market driving firm’s product-service offering and marketing strategy. This creates havoc in the industry by destroying the segmentation followed by the industry prior to the market driver’s entry and replacing it with a new set of segments reflecting the new, altered landscape:

- Aravind Eye Hospital did not accept the normal segmentation between rich and poor patients.

- Southwest Airlines destroyed the segmentation between ground transportation and airlines, attracting many who would not otherwise have flown at all.

- Swatch, with its cheap and fashionable watches, bridged the chasm between the segments for cheap, utilitarian watches and expensive, fashionable ones.

- Wal-Mart demonstrated that small rural towns could support huge discount stores which previously had located only in large urban areas.

- While existing software vendors concentrated on developing different software packages for different departments (e.g. manufacturing, sales, human resources), SAP destroyed these distinctions by developing enterprise software that could integrate and run the entire business.

1.3. Value creation through new price points

To deliver a leap in customer value, market driving firms establish new industry price points for the quality or service levels they deliver. Swatch, Aravind Eye Hospital, Southwest Airlines, and Charles Schwab all set prices much lower than those previously available for similar products. This puts existing competitors under tremendous pressure. The competitors must make dramatic changes in operations and product lines to survive, but they are unable to swiftly meet the challenge because they cannot quickly and successfully reproduce the innovative business system that enables the lower price point. Continental learned this the hard way when it tried to compete against Southwest Airlines with `Continental Lite’:

- When Southwest Airlines enters a new city they price against ground transportation as much as against existing air service. This typically results in prices at least 60 per cent below competitive airfares — sometimes over 75 per cent lower. For example, Southwest Airlines charged $15.00 for a trip from Dallas to San Antonio when Braniff, the next most inexpensive competitor, was charging $62.00. A shareholder asked the CEO, `Could you not raise the price two or three dollars?’ and received the response, `We are not competing against other airlines but ground transportation.’

- Swatch adopted a simple introductory pricing strategy — $40 in United States, 50 CHF in Switzerland, 60 DM in Germany, and 7000 yen in Japan — and kept those prices unchanged for the first 10 years despite high demand.

While the trend is towards higher performance at lower price points, there are market driving firms who have established elevated price points that are higher than typical in an industry. CNN, Starbucks, and FedEx set prices considerably above what customers had been paying. Inducing the buyer to pay these higher prices requires that these market driving firms have a value proposition that is significantly more compelling than the available alternatives.

1.4. Sales growth through customer education

Given the radical new concept, the sales task for market driving firms is not to sell but rather to educate the customer on the existence of, and how to consume, their radical value proposition:

- Aravind Eye Hospital has to continuously educate its `free’ patients, who are predominantly illiterate, that their vision can in fact be restored and that the necessary surgery is available to them free of charge.

- IKEA had to teach consumers the benefits of transporting furniture components home for self-assembly instead of buying it pre-assembled and delivered. When IKEA entered Switzerland, they ran advertisements which joked about the Swiss unwillingness to transport and assemble furniture, even for lower prices. The advertisements poked fun at the self-delivery and self-assembly aspects saying `That is a stupid thing’ and `You can’t do that to the Swiss.’

1.5. Channel reconfiguration

In almost every market driving firm, channel reconfiguration appears to play a critical role in generating the architectural innovation that results in a unique business system. Market driving firms have unleashed a wide range of innovative distribution and channel management practices within their industries:

- FedEx transported packages using its own planes via a `hub and spokes’ air freight system rather than the `point-to-point’ commercial flights used by competitors such as Emery. The result was that FedEx was twice as likely as Emery to deliver a package on time.

- On the other hand, Southwest Airlines does not employ the hub and spoke system used by the rest of the passenger airline industry, but rather concentrates on point-to-point short haul flights. Southwest flies into major cities’ less congested smaller airports which improves their on-time performance vis-à-vis major carriers. They used only Boeing 737s, reducing the costs of maintenance and pilot training. Furthermore, Southwest Airlines does all of its own ticketing and does not make seats available through the standard industry computerized reservation systems like Sabre and Apollo. As a result, only 55 per cent of Southwest’s tickets are sold through travel agents compared to 90 per cent for the industry, adding up to substantial savings on travel agents’ commissions.

- Benneton has set up a unique system where they subcontract simple, non-essential tasks. Only crucial quality-maintenance tasks such as dyeing are done in-house. Furthermore, by knitting products prior to dyeing rather than vice versa they can respond faster to sales data than the rest of the industry.

- Wal-Mart revolutionized manufacturer–retailer relationships by `forcing’ Procter & Gamble as well as its other suppliers to rationalize their product lines, adopt Everyday Low Prices, eliminate wholesalers, present one invoice per company, and establish electronic links with their stores (Kumar, 1996). This helped eliminate considerable costs in the value chain.

1.6. Brand attachment by capitalizing on the `buzz network’

Market driving firms often place greater reliance on the `buzz network’ to get their message across. Because these firms offer a leap in customer value, their customers are delighted and eager to notify others about their `find.’ Reporters in trade publications and the popular press also often publicize the radical new innovation. The commitment and enthusiasm of early adopters and opinion leaders generates excitement and an intangible brand cachet that the market driving firm strives to maintain. Consequently, market drivers don’t find it as necessary to spend a lot of money on traditional advertising; their advertising-to-sales ratio is often less than that of their established competitors:

- Benetton is a classic example of a market driving firm leveraging its controversial advertising to generate loads of free publicity and develop an image which arouses strong feelings among both those who love and those who hate them.

- Southwest Airlines boasts `We have a lot of ambassadors out there, our Customers.’ Every year representatives from dozens of cities beg Southwest to launch services in their cities.

- A 1958 13-page Life magazine photo spread on Club Med led to many more customers than capacity. In 1962, 12 years after the first village, they turned away more than a 100 000 applicants as they could only accommodate 70 000 members.

- Nike didn’t run a single national television ad until they had 1 billion dollars in sales. Phil Knight observes they instead `used word-of-foot advertising’ by getting the best athletes to wear their products.

- Virgin’s Richard Branson generates constant free press through his hot air balloon expeditions, highly public media wars against the established players (such as having all planes painted with a banner against the proposed BA–AA merger) and even making public appearances in `drag.’

1.7. Overwhelm customer expectations

Market driving firms exceed existing customer expectations which are typically formed through past interactions with competitors or existing alternatives. Part of the leap in customer value comes from delivering service at levels far above what consumers expect for the market driver’s price:

- The poor patients of Aravind Eye Hospital never expected to regain their sight, as under normal circumstances an operation would be out of their geographical, economic, and psychological reach.

- Because other discounters lower customers’ expectations by providing such poor service, Wal-Mart is perceived as providing great value despite its rather limited service. In Houston, an umbrella-wielding service rep walks customers to their cars when it is raining at both Wal-Mart’s discount store and Sam’s Club. This level of service is by a warehouse club that operates on slim 10 per cent gross margins! No wonder a typical Wal-Mart customer visits Wal-Mart 32 times a year compared to a loyal Kmart customer who shops only 15 times per year at Kmart.

- FedEx constantly led its customers to ever higher expectations for quick delivery times, leaving competitors struggling to meet the spiraling demands.

- Twelve times between 1987 and 1993, low-priced Southwest won the unofficial `triple crown’ of the airline industry — fewest customer complaints, fewest delays, and fewest mishandled bags — a feat no other carrier had ever achieved. CEO Herb Kelleher observed that `it’s easy to offer great service at a high cost. It’s easy to offer lousy service at low cost. What’s tough is offering great service at low cost, and that is what our goal is’8

- Obstacles to market driving in established firms

Most innovations in any industry are launched by the large, established incumbent firms within that industry, but these are predominantly incremental innovations rather than radical innovations. Since the success of market driving firms is based on radical innovation and turning existing industry rules on their head, market driving companies are usually new entrants to the industry.9 Often, the market driving ideas were available to, but rejected by, incumbents:

- Sam Walton, originally a Ben Franklin franchisee, had his idea for starting big stores in small towns turned down by the Ben Franklin franchise.

- Many major shoe manufacturers rejected the running shoe concept, which later was implemented by Nike.

- SAP was formed by ex-IBM employees after IBM Germany refused their request to develop enterprise software for ICI.

Why do successful incumbents find it so difficult to achieve the combination of radical innovation in both value proposition and business system? Primarily because four features of market driving ideas make their management problematic for firms with well-established new business development processes in place.

First, market driving ideas are maverick in nature. There is a degree of serendipity in the process. It is often not possible to predict where in the organization such an idea will arise or who will generate such an idea. However, since most companies are organized for efficiency, surprises are seen as negative events.10 Furthermore, individuals often feel pressure to hide market driving ideas as they rebel against the prevailing industry and incumbent wisdom. The vast industry experience of established firms therefore becomes a barrier to being market driving. It is difficult to unlearn received wisdom that has become irrelevant as the fundamentals of the industry shift (Hamel and Prahalad, 1994). An obsession with history — or even the present — can prevent a firm from grasping and shaping the future. Current market leaders often tend to discard maverick ideas from inside or from outside the company that don’t fit the prevailing industry wisdom. Borders, for example, has been slow to respond to the threat of `E-tailing’ booksellers like Amazon.com:

- Linotype-Hell, a German company, invented Linotype printing presses in 1886. The `hot-type’ Linotype system was widely used for printing books, magazines, and newspapers until the 1970s. Although the company had dominated every advance in publishing technology until that time, they were blind-sided by the digital age of software- and scanner-based printing. Linotype managers clung to the `hot-type’ mind set that came of age when typesetting involved loud clattering mechanical machines rather than lasers. The company’s stock had declined to a low of 56 DM in July 1996 from a record high of 970 DM in May 1990 and was ultimately acquired in 1997 by Heidelberger Druckmaschinen, AG.

Second, market driving ideas involve high risk. For every successful radical innovation in value proposition and business system, there are probably hundreds of failures that one never hears about. An entrepreneur chasing a market driving dream has bounded downside financial risk as he or she generally invests enormous effort but only limited capital. However, if the idea is successful, there is unlimited upside potential since a vast personal fortune can be made. In contrast, in most organizations, the originator of a successful market driving idea may, at best, receive a nice bonus or promotion (limited upside potential), but a public failure may be the end of one’s career within the organization or even beyond (substantial downside potential). When one combines the high failure rate of radical innovation with the risk/reward ratio in most large organizations, pursuing market driving ideas is not a rational strategy for individuals in such organizations.

Third, the new business development process in most firms tends to be biased against, and therefore squelches, the more innovative breakthrough ideas that could potentially create new markets. In most market-leading firms, the new product development and new business development processes favor projects that are triable, reversible, divisible, tangible, familiar, serve current customers, fit with the organization’s direction, and are consistent with sunk costs invested in R&D, corporate image management, sales training, and channels — all of which are rarely characteristic of radically innovative market offerings. Established firms select new business development opportunities on the basis of technological feasibility and potential market size. However, in the early stages of radical new business development, it is difficult to know which technology will succeed, with what capabilities, for which markets. The technological and operational problems seem insurmountable, often with no obvious market in sight. Expected applications dissolve and unforseen opportunities emerge while the firm is still experimenting:

- Two initial applications for Nutrasweet — artificially sweetening breakfast cereals and replacing saccharin — fizzled while an unanticipated market sizzled. Nutrasweetened breakfast cereal ran into technical and regulatory obstacles and saccharin users rejected Nutrasweet because it did not have the aftertaste of saccharin! Instead Nutrasweet found a market with dissatisfied sugar users (Lynn et al., 1996).

Finally, established firms often perceived that they have too much invested in the status quo to risk destroying the existing industry and market. The greater the threat of cannabalization, the more intense is the resistance to market driving ideas:

- IBM remained focused too long on mainframes at the expense of personal computers because PCs required a different distribution system, had lower margins, and was not as after-sales service intensive as the mainframe business.

- General Motors and Ford were slow in responding to the popularity of minivans because it put their conventional station wagons at risk.

- For fear of cannibalizing their permanent soft lens and solution businesses, Bausch and Lomb ignored disposable soft lenses, which are more comfortable and provide better vision for the consumer.

- From market driven to market driving

Although new entrepreneurial firms can single-mindedly pursue a make or break market driving perspective, most established firms have too many obligations and too much to lose to justify the obvious risks of chasing only radical market driving `big hits.’11 In such firms, the search for radical business innovation should not be pursued to the detriment of improving the existing business. Incumbent firms should devote the overwhelming majority of their innovation efforts to market driven activities, such as incremental innovation and traditional market research. Nevertheless, some room must be found for radical business innovation or the market leader risks being leap-frogged and deposed by upstart market drivers. Projects need to be chosen in the context of other projects in the company’s portfolio so that there is an adequate balance between incremental and radical innovation. Thus, as Tushman and O’Reilly observe, firms need to be ambidextrous, capable of simultaneously managing incremental as well as radical innovation (Tushman and O’Reilly, 1996).

Unfortunately, established firms find it difficult to generate and launch radical market driving innovations. An established firm that wishes to engage in market driving must meet two challenges — it must have the vision and environment to generate breakthrough ideas and it must have the capital, fortitude, and risk tolerance to persevere and allow the radical idea to have a fair chance to succeed. The first is the upstream creative challenge of developing the ability to `see differently.’ Since radical concepts often spring from the imagination of a single individual, the firm must create an environment where creativity in individuals may flourish. The second is the downstream implementation challenge of successfully marketing the unique concept, which requires a team effort. Without the ability to see differently, the firm is unable to change the rules of the game and must battle to brand-switch buyers of competitors’ products in existing markets. And, without the ability to implement a market driving concept, the firm will join the ranks of companies that failed to capitalize on their inventions such as Xerox with personal computers and EMI with scanner technology.

Unlike incremental innovation, where a well-developed innovation process clearly is an asset, the development of market driving ideas is more project based. It is also difficult to predict who in the organization will develop a market driving idea and when they will do so. Perhaps what Somerset Maugham observed about writing novels applies here: `There are three rules for writing a novel. Unfortunately no one knows what they are.’ While we recommend some practices that will help established firms increase their probability of developing market driving innovations, even if all of these practices are employed, they will not guarantee that a market driving innovation will be discovered. Some market driving firms do not engage in all of these practices. Nevertheless, if these practices are instituted, the firm will be better positioned to discover and implement market driving innovations independent of the people running the company. What we find of particular concern, however, is that many of today’s management trends are unfortunately moving in directions that make it less likely market driving ideas will arise and thrive.

3.1. Allow space for serendipity

Serendipity has played a role in the development of many radical new ideas. To allow for serendipity, 3M researchers are encouraged to spend up to 15 per cent of their time on a research project of their choice. This ensures that problem driven research does not preclude all curiosity driven research. 3M’s famous Post-It notes were invented when an associate was attempting to develop a better bookmark for his hymn book. Similarly, one of Searle’s research scientists discovered the artificial sweetener Nutrasweet while looking for a possible treatment for ulcers. As Schumpeter observed: `History is a record of “effects,” the vast majority of which nobody intended to create.’ Unfortunately, re-engineering efforts in most firms have eliminated much of the slack within which serendipity thrives.

3.2. Select and match employees for creativity

To generate new ideas, Nissan Design International deliberately promotes `creative abrasion’ by hiring people in contrasting pairs (e.g. balancing nerds with hippies). Employees are encouraged to display color charts of their `personalysis’ to help managers do the mixing. For implementation of creative ideas, Henry Ford looked towards inexperienced employees: `It is not easy to get away from tradition. That is why all our new operations are always directed by men who have no previous knowledge of the subject and therefore have not had the chance to get on really familiar terms with the impossible’ (Ford, 1988). In many market leaders, however, rounds of testing and interviews do more to reinforce conformity than to assemble a collection of individuals with diverse capabilities and perspectives.

3.3. Empower latent entrepreneurs and offer multiple channels for new idea approval

Even firms with a history of prior market driving activity find it difficult to keep the fires of iconoclastic creativity stoked. Today’s successful market driver must beware ossifying into the cautious, market driven behemoth of tomorrow. In any large firm can be found many frustrated potential entrepreneurs who have ideas as yet unveiled. In most organizations, approval of a new business idea requires several `yes’ votes as it moves up the hierarchy while a single `no’ can kill it; the nature of radical market driving innovation is such that it is almost certain to gather a `no’ somewhere in the process. To help promising new ideas surface, an idea generator at 3M has numerous channels that can be used for securing approval and support for a project if one’s immediate superior rejects it. Providing alternative routes for approval changes this dynamic to one where a project garnering a single `yes’ vote in the face of several `no’ votes still proceeds.

Japanese firms like NEC have launched competitions to find maverick ideas, harness individual initiative, and develop entrepreneurs among its employees (see Example 1). Similarly, Toyota’s Dream 1995 campaign encouraged `entrepreneurs with new business ideas to serve as presidents of new businesses’ to submit proposals to their Business Development Department. Toyota realized that the traditional strength of guaranteed lifetime employment reciprocated by deep commitment on the part of employees had unintentionally created a passive culture `which reacts to events rather than drives change’ (emphasis in original).12 The poster of the program screamed, `The president’s chair is waiting for you.’

3.4. Establish competitive teams and `skunk works’

In the early stages of the development of a radical new concept, it is not readily apparent which technology or format will succeed and which market will materialize. Therefore, Motorola encourages its wireless divisions to compete against each other on the assumption that the marketplace will select the winner. IBM had about half a dozen parallel development teams for the PC. Often when selecting a particular new technology as its main focus, Sharp maintains small R&D projects on the alternative technologies.

In an established firm, a radical new concept will typically either fall outside the current business definition or target markets of the firm (e.g. Nutrasweet for Searle) or pose a serious threat to destroy much of the firm’s existing business (e.g. IBM’s personal computer launch). In addition, market driving projects, by definition, require a unique business system, which means limited synergy with the firm’s existing business system. When market driving ideas are pursued within the existing business structure, other priorities often hinder their successful, speedy fruition.

To help overcome organizational resistance and inertia, firms can set up `skunk works,’ physically and organizationally independent, self contained entities with dedicated members.13 Skunk works bring a sense of urgency to the project, harness the entrepreneurial zeal of members, and concentrate the effort of those involved; importantly, they also protect the fledgling business from entrenched interests who have motives to kill the project. 3M, IBM, Apple, Raychem, DuPont, Ericsson, General Electric, Xerox, and AT&T, all use skunk works to capture the soul of a small, entrepreneurial outfit within the body of their large firms. Although some companies have recently become disillusioned with skunk works, we believe in many cases this results from using skunk works inappropriately, specifically, for incremental innovation and related businesses. Skunk works are most effective when used to develop and unleash market driving ideas.

3.5. Cannibalize your own

The natural tendency of established market leaders to protect their core business makes it difficult for them to voluntarily pursue avenues that threaten to undermine that core. For example, Kodak’s desire to ensure that its new digital business does not encroach on its traditional film business has slowed their progress in digitial imaging. Pablo Picasso once observed, `Every act of creation is first of all an act of destruction.’ Market driving explicitly encourages cannibalization, based in the belief that some firm will cannibalize that core business, so we had better do it ourselves. When Sony introduces a major new product, three teams are created — the first team tinkers with minor improvements, the second seeks major improvements, while the third explores ways to make that new product obsolete. At Hewlett-Packard, which fosters competition among its divisions, products less than two years old account for 60 per cent of orders. Market driving retailers such Starbucks and Sam’s Clubs of the United States, Sweden’s Hennes and Mauritz, and Italy’s Benneton strategically cannibalize their own stores to some extent by building new outlets close to existing, successful locations, thereby leaving few vacant spaces for competitors to exploit. They believe in keeping the cannibals in the family.

3.6. Encourage experimentation and tolerate mistakes

Developing an experimenting organization that seeks creative solutions requires a tolerance for mistakes. Firms must probe and learn in the marketplace, improving with each successive generation. The first Wal-Mart store was horrible but Sam Walton improved the format over time by trying different ideas and watching customer reaction. Similarly, the original Nike shoe wasn’t very good but they kept learning and improving the technology. Luciano Benetton, the founder of Benetton, observed that the best market research is to open a new store and learn. As Ingvar Kamprad of IKEA observed, `Only while sleeping one makes no mistakes. The fear of making mistakes is the root of bureaucracy and the enemy of all evolution.’14

In the United States, the focus on daily stock price, quarterly results, and Wall Street analysts tends to severely punish missteps. This is another hurdle that large, publicly traded market leaders must manage in order to effectively cultivate market driving activity. The company needs to carve out a sheltered area where the risk-taking associated with experimenting can be tolerated and where there is room for the inevitable failures that will sometimes ensue. These potential failures are the price the firm must pay to cultivate market driving, but they need to be planned for so as not to cause unexpected shocks. However, there must be some rules with respect to failures. David Pottruck, CEO and President of Charles Schwab, articulated the following three rules: (1) Don’t put the company at risk. By limiting the enormity of possible failure, one ensures that employees bet the horse, not the farm. (2) Take reasonable precautions against failure. (3) Learn something from it (Pottruck, 1997).

- 4. Conclusion

Over time, even successful market driving firms change, as they should, into market driven firms. The history of innovation is a pattern in which bursts of breakthrough innovation which reshape an industry are interspersed by flows of less dramatic incremental improvements and refinements. Once the radical innovation phase is over, incremental innovation to improve the existing offering and business system becomes the primary, immediate challenge. Furthermore, competitors ultimately emerge with competitive, or even superior, value propositions and business systems modeled after the `new’ market leader. It is at this stage that market driving firms, like Tetra Pak today, must search for their next market driving innovation. However, as the successful market driver transforms into an established market leader, it faces all the same obstacles to motivating market driving strategies that the former market leaders faced. With age and size, firms tend to become increasingly bureaucratized, routinized, and risk averse. To date, very few firms have been able to consistently launch a series of successful market driving ideas. Sony has been one such exception. We therefore end with an example (Example 2) from Sony and their development of computer diskettes which demonstrates how they utilize almost every practice recommended above to create a market driving culture.

- Example 1: Discovering, cultivating, and empowering latent entrepreneurs at NEC

In 1992, to give new business ideas space to develop outside the corporate bureaucracy, NEC invited its employees to submit proposals for their own start-up companies. Entitled `Venture Promotion and Entrepreneur Search Program’ it generated 146 ideas. One selected proposal was submitted by Mr Shirota, a 56 year old career NEC employee. His business idea was to develop and market a software program which would provide a high-tech design tool for Japan’s kimono makers. By scanning the customer’s photograph into a computer and then graphically superimposing kimonos, the customers can `try on’ different kimonos without actually changing outfits. The company, Kainoatec, was launched in 1995 with NEC providing 54 per cent of the 13 million yen start-up capital and with Mr Shirota and a colleague, Mr Koterazawa, each chipping in 3 million yen. Since its launch, Kainoatec has developed similar software for the eyeglass industry so that customers can try on spectacles without having to remove their own eyeglasses. The venture generated profits of nearly 5 million yen in its first year and has increased sales and profits every year since then.

Authentic Limited is another company launched as a result of the proposals generated in 1992. It makes top-of-the line stereo speakers from granite. This company has since developed the tiniest speaker in the world for personal computers as well as a flat speaker in collaboration with New Transducers Ltd, a UK based company. The flat speakers have been incorporated in a new NEC notebook computer launched in August 1997. The ultra thin panel speakers slide out from behind the LCD display and provide superior sound for multimedia applications on the go. This venture was the idea of 46 year old Mr Kondo, who had worked for an NEC subsidiary for 15 years. He contributed 30 per cent of the capital while NEC contributed the rest. Authentic currently employs 36 people and 1997 sales are anticipated to be in excess of 5 billion yen.

The in-house entrepreneur program has become an annual event at NEC. More than 600 new business ideas have been generated. To maximize the number of proposals, the annual invitation is widely publicized to all employees of NEC and its subsidiaries. Furthermore, initial proposals are limited to presenting only an overview of the new business concept. Later, as proposals move through various selection steps, projected sales, profits, and investment information are gathered through detailed business plans. As Mr Shirota, now President of Kainoatec, observes, the program helps discover hidden entrepreneurs among the Japanese salarymen who are waiting for someone to tap them on the shoulder and give them a chance.

- Example 2: The market driving culture at Sony

Sony has been a powerhouse in developing and launching innovative products which have created new markets and businesses, such as the transistor radio, Walkman, 3.5 inch diskette, and audio compact attest. `New products create new markets’ is a guiding credo at Sony. Sony claims that their strongest assets are employees who combine dreams of creating new products or markets, with the passion and enthusiasm to execute them.

Sony practices several principles that large, established companies should adopt to become more market driving. Sony leaves room for experimentation, tolerates mistakes, cannibalizes its own, encourages competitive teams, and offers multiple channels for approval of new ideas. They also nurture and reward individual creativity as illustrated by the following story.

In 1980, three teams in two departments were working in parallel to develop a 10× improvement to the conventional 5.25 inch `floppy’ diskette. Initially, each team was essentially a single individual with a distinct vision of the product concept. The first individual envisioned it as a more compact floppy, the second individual visualized it as a 3.5 inch plastic encased disk, and the third individual, who was in a different department, was working on a 2 inch diskette with high rotation speed. At this stage, it was unclear whether any of these would deliver a product that could be marketed successfully.

After three months, the first team had encountered several technical problems while the second team, led by 28 year old Mr Kamoto, had developed a promising prototype (an early version of the 3.5 inch plastic-encased diskette that is the world standard today). Since they belonged to the same department, the first team was disbanded with the former members redirected to other projects, including a few who were assigned to the second team. The former leader of the first team was asked by the head of the department to author and present a paper on the 3.5 inch diskette at an upcoming Japanese technical conference. It was explained to Mr Kamoto that while all the internal recognition at Sony for the invention of the 3.5 inch diskette would go to Mr Kamoto, it was important to keep the former leader of the first team motivated.

The 3.5 inch diskette, unveiled at the Chicago industry show in 1981, piqued Apple’s interest. In 1983, Steve Jobs, the founder of Apple Computer, adopted the new diskette for the Macintosh, demanding assurances that the product would be substantially improved within one year. The enhanced system would be double-sided rather than single-sided, incorporate an automatic inject and eject system, and still reduce by 50 per cent power consumption, height of the disk drive, and price. Despite these improvements, the product was still ignored by most of the larger IBM compatible world, adopted by only two major customers, Apple and Hewlett-Packard. In 1987, Mr Kamoto was transferred to sales and marketing despite having no experience in these functions. It was thought that only he, having invented the 3.5 inch diskette, had the passion to make it a worldwide standard. Today, it has replaced the 5.25 inch floppy diskette as the standard format for storing data by personal computer users.

In 1991, Sony put Mr Kamoto in charge of improving its languishing personal computer internal hard drive business, hoping that he would do for hard drives what he had done for the 3.5 inch diskette. Unfortunately, despite his best efforts the venture was an expensive failure and Mr Kamoto was asked to close down the operations. Given this highly visible failure, Mr Kamoto thought his career at Sony was effectively over. Sony, however, recognized that he was motivated by his enthusiasm to contribute to the company and accepted the failure as a learning experience. Following the hard drive fiasco, Sony gave Mr Kamoto the responsibility for managing another data storage device, the magnetic tape drive. Under his charge, Sony’s worldwide market share for magnetic tape drives increased from 3 to 25 per cent over three years.

While Mr Kamoto and the 3.5 inch diskette were moving from strength to strength, the leader of the third team, Mr Kutaragi, was struggling. His design for the 2 inch diskette was completed in 1982, the year after the 3.5 inch diskette. Mr Kutaragi’s diskette delivered excellent performance, but its architecture required significant changes in the associated hardware. As a result, no company other than Sony adopted it. Unfortunately, Sony’s laptop, `Produce’ launched in 1983–84, did not succeed and Mr Kutaragi had to search for other applications for the 2 inch diskette.

The diskette found its next home in Sony’s new still camera called `Mavica’ which, despite high expectations, failed. Mr Kutaragi, doggedly persisting in the face of continuing failure, then approached Nintendo in the hope of persuading them to use the 2 inch diskette with their video game software. When Nintendo signed a contract with Sony for the 2 inch diskette, Mr Kutaragi thought he had finally found the killer application for his invention. Three years later, Nintendo canceled the contract without ever using the product.

A disappointed Mr Kutaragi approached Sony’s leadership with a proposal to develop their own line of video games using CD-ROMs. Mr Kutaragi convinced Sony that his three years of discussion with Nintendo had given him a deep understanding of the video game business and insights into Nintendo’s strengths and weaknesses. With assistance from Sony’s business strategy group, PlayStation video games were developed and launched in 1994 as a competitor to Nintendo. Since its launch, more than 50 million PlayStations have been sold and Sony presently controls 60 per cent of the 15 billion dollar video-game market.

Acknowledgements

The authors wish to thank an anonymous reviewer for several helpful comments. The first author gratefully acknowledges financial support from IMD Faculty Research Funds as well as introductions by Professors Robert S. Collins and Dominique Turpin at NEC, Sony and Toyota.

![]()

NOTES

1. An excellent source for more details on this example is V. Kasturi Rangan, The Aravind Eye Hospital, Madurai, India: in service for sight [Harvard Business School case 9-593-098].

2. Several authors make the point that market research is less useful in generating radical innovation (e.g. Lynn et al., 1996). In their study of `breakthroughs’ Nayak and Ketteringham noted that in every case it was the curiosity of the inventor rather than market pull or financial need that was the motivating force behind the breakthrough. However, it must be noted that while our focus is on radical innovation, every firm must also engage simultaneously in incremental innovation. In fact, incremental innovation for most companies should encompass the vast majority of their innovation efforts. Despite its limitations with respect to radical innovation, market research is invaluable for helping firms with incremental innovation (see Lynn et al. 1996, Nayak and Ketteringham 1993).

3. Wal-Mart Stores, Inc. [Harvard Business School case 9-794-024].

4. Our view of innovation has a considerable lineage in the strategy literature. We adopt Tushman and Anderson’s distinction between incremental and radical innovation, also referred to as continuous versus discontinuous or evolutionary versus revolutionary innovation. Subsequently this distinction has been applied to new product development (Christensen and Bower 1996, Leonard-Barton 1992). Because market driving is more than just developing a new product, we apply the incremental versus radical distinction to business innovation. Business innovation is similar to Markides’ notion of strategic innovation which he defines as changing the rules of the game without the help of technological innovation. Market driving is both similar and different from strategic innovation. It is similar in that we are also examining changing the rules of the game without technological innovation but, as we understand it, for Markides this change in the rules of the game could be the result of either radical or incremental innovation with respect to value proposition and/or business system. In contrast, we prefer to distinguish innovation on two dimensions — value proposition (what is offered to the customer) and business system (how the company creates and delivers its value proposition) — and restrict market driving to firms that engage in radical innovation on both dimensions. Innovation in the value proposition has previously been mentioned by Kim and Maugborne, without however the emphasis on incremental versus radical, and we borrow their term value innovation. Our conceptualization of the business system is similar to Porter’s value chain concept and we borrow the term architectural innovation from Henderson and Clark (see Tushman and Anderson 1986, Christensen and Bower 1996, Leonard-Barton 1992, Markides 1997, Kim and Mauborgne 1997, Porter 1985, Henderson and Clark 1990).

5. The authors are deeply indebted to Professor Xavier Gilbert for sharing his presentation `Achieving Exceptional Competitiveness’ [1997]. We adapt his conceptualization of the IKEA business system.

6. See Kotler (1997)for a discussion on the differences between sales driven and market driven companies. Customer driven and market driving are our own conceptualizations.

7. See Nayak and Ketteringham (1993)for the Federal Express story.

8. Southwest Airlines: 1993 (A) [Harvard Business School case 9-694-023].

9. Tripsas’ study of radical technological innovation indicated that new entrants succeed over incumbents in those situations where the innovation devalues the existing complementary specialized investments of incumbents. Since in our conceptualization, market driving firms are those that develop a unique business system, it follows that the existing business system of incumbents is devalued and therefore market driving firms tend to be new entrants (see Tripsas, 1997).

10. Professor Jay Galbraith observed this during a lecture attended by the first author.

11. There may be however some critical junctures when a large successful company has to bet on a future and reinvent itself. Hewlett-Packard, Intel, and Nokia are frequently cited as examples of this.

12. Internal Toyota documents.

13. There is considerable literature on skunk works. Some useful articles for practitioners are Gwynne (1997), Single and Spurgeon (1996).

14. Ingvar Kamprad and IKEA [Harvard Business School case 9-390-132].

Copyright © 2000 Elsevier Science Ltd. All rights reserved.

![]()

Articles by John Hatt

Other Articles

![]()

![]()